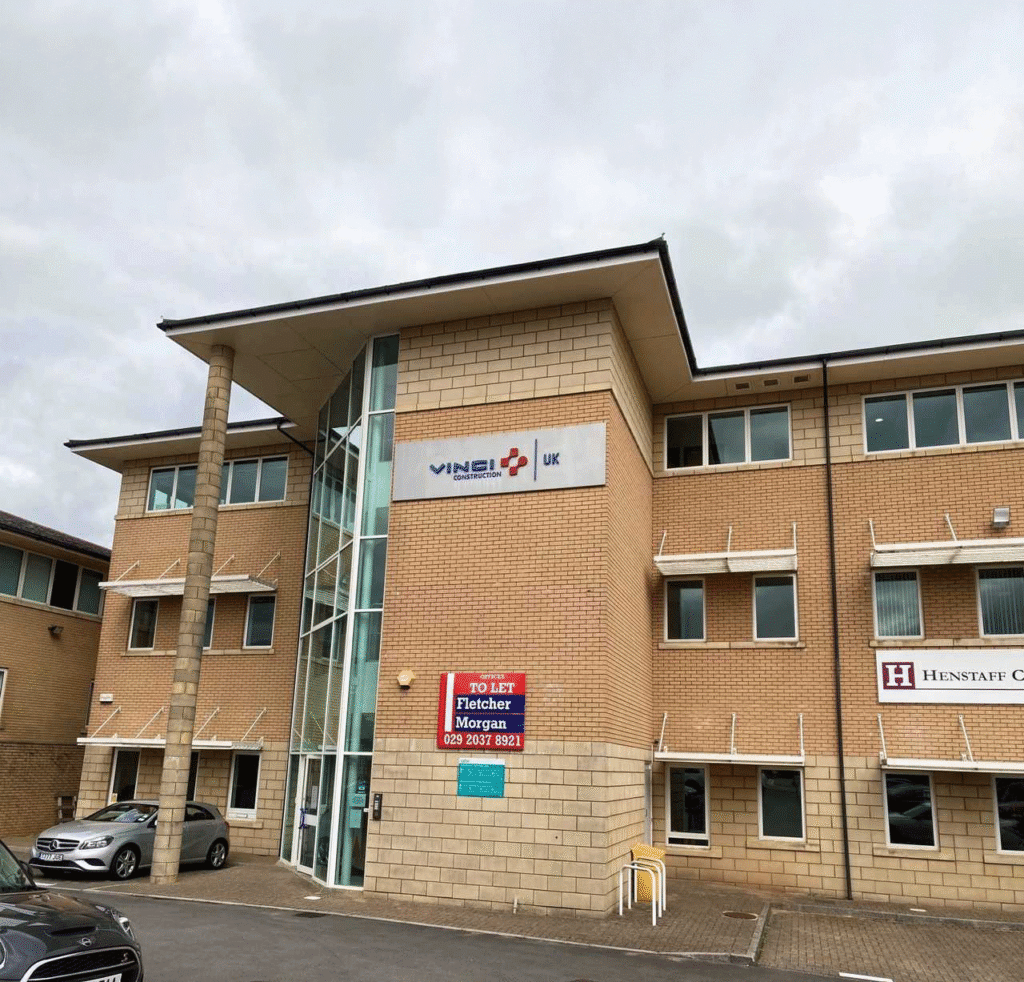

Recognise Bank has successfully completed a gross £1.795 million bridging loan across multiple industrial sites and land in Lincolnshire for an established development and construction business. Completed in partnership with Archway Capital Partners, the facility will allow the client to maximise sales values across the commercial units on the sites.

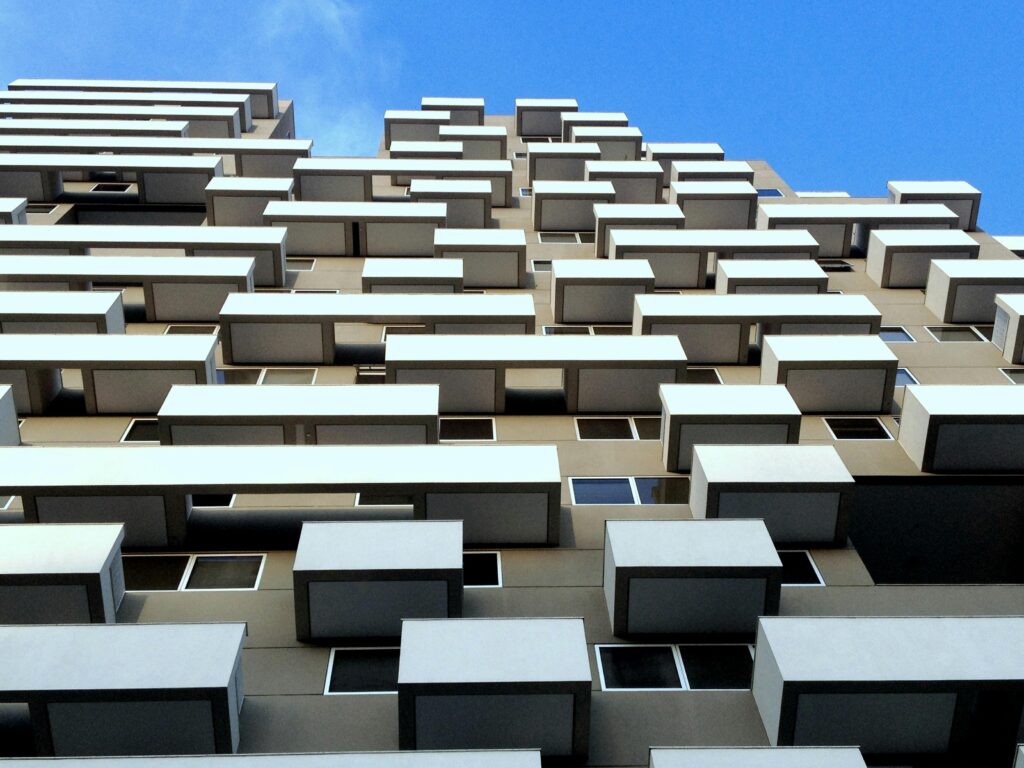

The borrower, part of a long standing, family owned group, recently completed two industrial sites across Lincolnshire as well as two landbank sites with planning permission in place. The bespoke bridging facility structured by Lending Managers, Ian Fields & Heather Mitchell, provided the client with a short-term solution to allow time for asset sales and to support their strategic development pipeline in the future.

With a diverse portfolio of developments and construction projects across the commercial, industrial, residential and educational sectors throughout the East Midlands, the client showcases the variety of customers Recognise Bank is proud to support.

This is the latest bridging deal completed by Recognise Bank which reinforces the bank’s commitment to supporting experienced property developers and UK SMEs with responsive, bespoke financing solutions.

Sam Monk, Director at Archway Capital Partners commented, ‘It has been a great pleasure to work with Ian, Heather and Stephen to complete this deal and support our client. The Recognise Bank team crafted a bespoke solution, provided timely responses and maintained great communication throughout. We look forward to working with the team again in the future.”

Ian Fields, Senior Lending Manager at Recognise Bank said, “We are delighted to have worked with Sam and the Archway Capital team to faciliate the next phase of growth for another successful UK SME. Providing bespoke financial solutions is at the very core of what we do and this deal is a great example of what can be achieved when lender, broker and borrower work together.”

Explore our flexible Bridging Loan solutions, built to support your clients’ needs.