Bridging Loans

- Borrow from £250,000 to £10 million

- Flexible loan terms of up to 24 months

- Expert guidance and support from start to finish

- Perfect for quick property purchase or refinancing

Product highlights

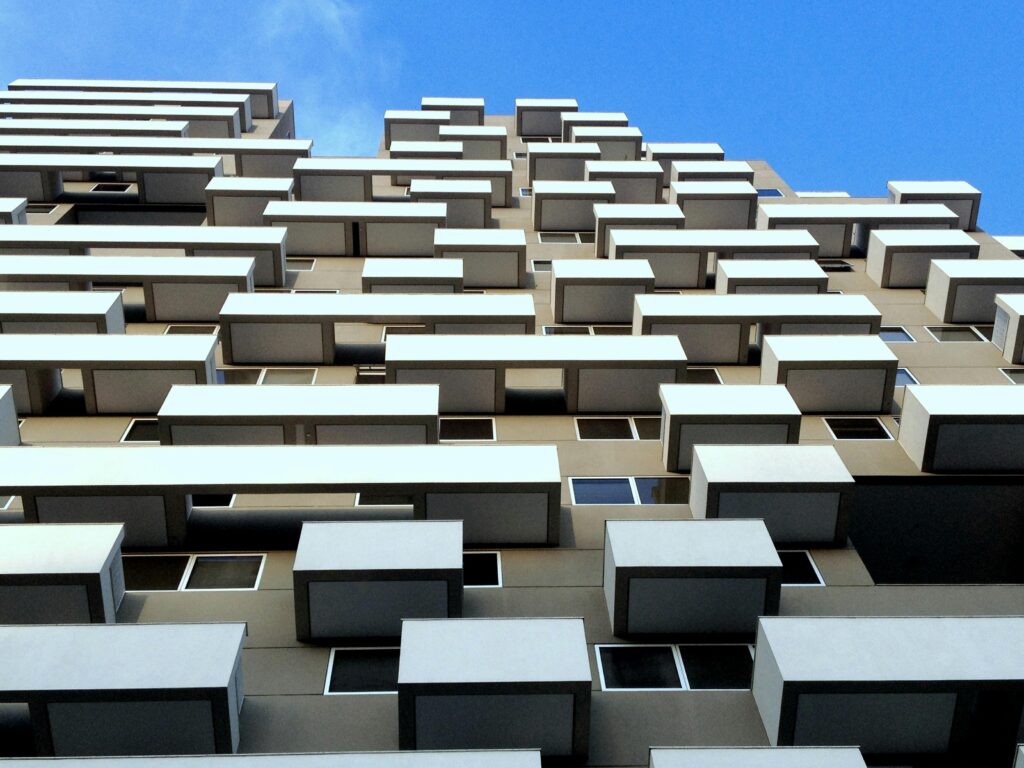

Residential bridging loan

- Borrow £250,000 - £10 million

- Up to 75% LTV available

- Flexible terms up to 24 months

- Tailored-to-you pricing with rates available from 79 bps per month

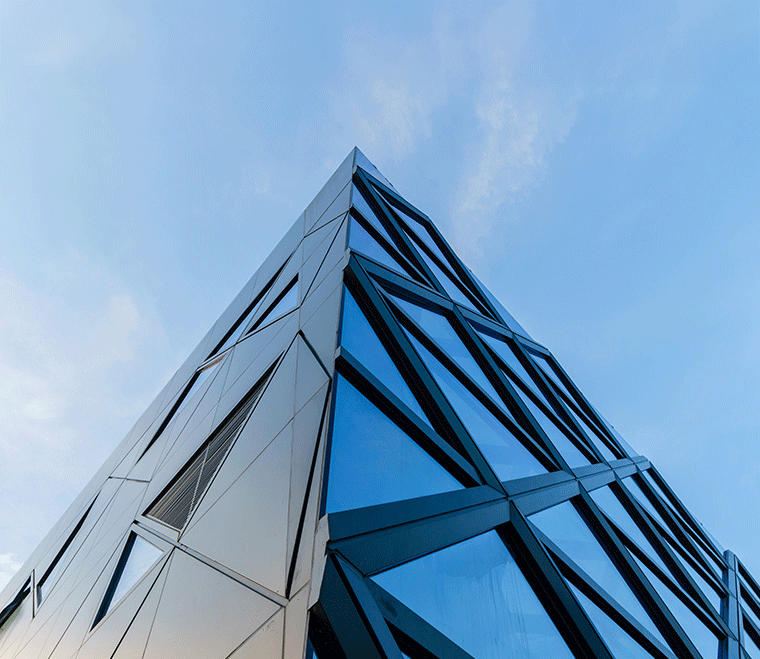

Commercial bridging loan

- Borrow £250,000 - £10 million

- Up to 70% LTV available

- Flexible terms up to 24 months

- Tailored-to-you pricing with rates available from 84 bps per month

Applying for a loan is easy. Here’s what to expect:

Make an enquiry

Contact us today using our short and simple online enquiry form.

Guided application

Our team will be in touch to discuss your needs and help you complete the full application.

Swift access to funds

Ongoing support

Enjoy access to your dedicated relationship team throughout the life of your loan.

Start your journey with Recognise Bank

Check if you’re eligible for a bridging loan by making an enquiry today.

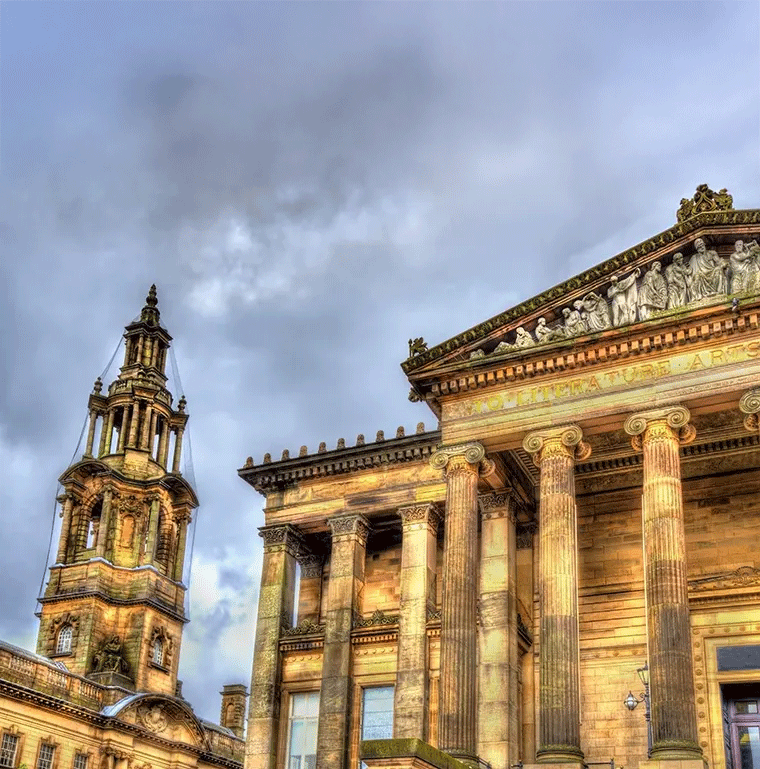

What is a bridging loan?

Bridging loans are a short-term option for property investors and business owners who require quick finance. We’ve designed this loan for several business types including Sole Traders, Partnerships, Limited Companies and LLPs. Businesses can use a bridging loan for:

- Buying a property at auction

- Purchasing property which requires refurbishing

- Buying land for property development

Recognise your potential

We believe business shouldn’t be held back by a bank.

That’s why we’ve made it our mission to create a fully licensed digital bank which puts relationships first.

We work with businesses not against them. And we aim to be as flexible as possible with all of our offerings and services, no matter what your business needs. It’s why our customers, brokers and partners love working with us.

Explore our range of award winning savings accounts, business loans, and specialist mortgages today and let us help your business thrive.

Explore our range of lending products

What our brokers say

It has been a great pleasure to work with Ian, Heather and Stephen to complete this deal and support our client. The Recognise Bank team crafted a bespoke solution, provided timely responses and maintained great communication throughout. We look forward to working with the team again in the future.

– Sam Monk, Director, Archway Capital Partners

Recognise Bank brought exactly the kind of insight and responsiveness our client needed in order to navigate a complex brief. Ian and the team demonstrated a clear understanding of both the challenges and potential of the deal. Their collaborative and agile approach helped us to deliver a strong outcome – and a very happy client. We look forward to working with Recognise again in the future.

– Colin Anderson, LDN Finance

I want to extend my thanks to Paul, Heather and the wider team. This was a complex case, with many hurdles to overcome and it required a commercially minded lender which I am pleased to have found in Recognise Bank. The speed and efficiency with how this deal was executed puts Recognise a cut above the rest.

– Chirag Sheth, Director, Infinite Finance

This has been a fantastic first deal with Recognise Bank – Courtnay, Stephen and the wider lending team have been a great support and showed a real understanding of the borrowers needs. Their professional and proactive approach has been crucial, our mutual client was delighted with the service received and we look forward to working together again in the future.

– Sinead Cowgill, Eight Finance Group Limited

It has been a great pleasure to work with Ian, Heather and Stephen to complete this deal and support our client. The Recognise Bank team crafted a bespoke solution, provided timely responses and maintained great communication throughout. We look forward to working with the team again in the future.

– Sam Monk, Director, Archway Capital Partners

Recognise Bank brought exactly the kind of insight and responsiveness our client needed in order to navigate a complex brief. Ian and the team demonstrated a clear understanding of both the challenges and potential of the deal. Their collaborative and agile approach helped us to deliver a strong outcome – and a very happy client. We look forward to working with Recognise again in the future.

– Colin Anderson, LDN Finance

I want to extend my thanks to Paul, Heather and the wider team. This was a complex case, with many hurdles to overcome and it required a commercially minded lender which I am pleased to have found in Recognise Bank. The speed and efficiency with how this deal was executed puts Recognise a cut above the rest.

– Chirag Sheth, Director, Infinite Finance

This has been a fantastic first deal with Recognise Bank – Courtnay, Stephen and the wider lending team have been a great support and showed a real understanding of the borrowers needs. Their professional and proactive approach has been crucial, our mutual client was delighted with the service received and we look forward to working together again in the future.

– Sinead Cowgill, Eight Finance Group Limited

Common questions about bridging loans

Our bridging loans are unregulated and designed for business purposes only. We currently accept applications from the below entities:

- Sole trader

- Partnership

- Limited Company

- PLC

- LLP

- Trust

- SIPP

- SSAS

The time it takes to secure a bridging loan varies depending on your business’ specific circumstances. At Recognise Bank, we offer a streamlined application process and typically make quick decisions. Our dedicated team is also available to guide you through the entire loan application process, ensuring you receive the necessary support.

In general, applying for a bridging loan involves these steps:

- Enquiry: Send us a simple enquiry today – it takes just 2 minutes. Click here to start yours.

- Full Application: We’ll be in touch to help you complete and submit the required paperwork.

- Evaluation: We’ll review your loan application, review your credit history and assess your exit strategy for repaying the bridging loan.

- Approval and Funding: Once approved, we will work with you to complete your loan as soon as possible.

Bridging loan fees may include arrangement fees, valuation fees, legal costs, broker fees or early repayment charges.

The fees we charge are determined on a case-by-case basis in accordance with our terms and conditions.

Please send us an enquiry and a member of the team will be able to discuss these with you in detail.

The loan amount we can provide will be assessed when we receive your application for a bridging loan. The minimum loan size is typically £250,000 up to a maximum of £10 million for residential bridging loans and £7.5 million for commercial bridging loans.

We’ll finance up to the quoted Loan to Value percentage, and you will be responsible for covering the remaining balance required to meet the property’s purchase price.

Deals we have completed

Can't find what you're looking for?

Check out our savings FAQs or contact us for additional support.